Welcome to September 2018’s business income report where I show you how I made money online last month. It’s time to look at this month’s update and see how I did.

Welcome to September 2018’s business income report where I show you how I made money online last month. It’s time to look at this month’s update and see how I did.

If you’re new to Making Sense of Cents, you may be wondering why I would want to publish my income report each month. You can simply skip to the next section if you’re not new here.

This all started out as my extra income report because, in the beginning, it was all about the money I was earning from my side jobs. In my side income reports from the beginning, I included all of the income I made except for what I made at my day job.

However, I left my day job as a financial analyst in October of 2013 and now my monthly income reports consist of the many ways I earn a living.

Many have asked why I would ever want to publicly post my income each month. Some think I’m crazy, whereas some are glad I’m open about what I’m doing. Whatever you think, I enjoy publishing my monthly online income reports and I share them publicly for three main reasons:

- Before I started blogging, I knew nothing about side hustling and making money online. I didn’t think side jobs were worth the effort and I thought the only way to significantly increase your income was through raises at your full-time job. If it weren’t for others publishing their monthly income reports, I don’t know if I would have ever tried side hustling. I want to help show others the positives in side hustling and how it can change a person’s life. There are many different ways to make money online, and I like to share my story each month to help motivate others to improve their financial situation by making more money.

- Secondly, I like to publish my income reports because it’s a way for me to look back, learn from my mistakes and actually see what areas need improvement. I use my monthly income reports as a way to track how I’ve done and I treat it sort of like a journal.

- Lastly, I like to show others that making side money is possible and that there are many legitimate ways to make money from your home. If you are looking for information on the many ways to make money online, I published the article Monthly Income Report Roundup that showcases many successful bloggers who are kind enough to share their income with the public each month.

I know I say this every month, but it’s the truth. Life is great now that I’m my own boss and a full-time blogger. I look forward to each and every day and it’s a wonderful feeling. I truly love waking up every single morning.

Above are just a few of the reasons for why I enjoy publishing my monthly income reports. I like to show others that you don’t have to hate your job and hate your life. You can make changes to your life and make money in a way that allows you to truly enjoy the life you are living. I’m not saying that you have to LOVE your job, I’m just saying that your job should, at least, allow you to do what you like to do outside of work (whether that be spending time with loved ones, painting, hiking, etc.).

How was business income in September of 2018?

I earned $104,814 blogging and online in September of 2018, before expenses.

September was a great month for Making Sense of Cents and the whole blogging business. I earned a great income and enjoyed my month.

I feel like I’ve been working less and less, and yet income is still staying at a great level, which is a really great feeling. It’s great to know that all of that hard work that I put in throughout the years is paying off, which is allowing me to better improve my work/life balance.

I don’t think I spent more than 10 hours working each week in September, which was nice but I definitely miss working!

I have big plans for the rest of the year, but I need to buckle down and actually start working. I think I’m actually going to get a planner soon and be more organized, haha! Does anyone recommend a good monthly calendar? Something simple – I just need something to organize my months. I’ve just always used my phone, but I’m starting to think that writing it down will be better so that I can see it all without having to click everywhere.

The last few months have seen a similar income level (around $100,000) due to the normal summer blogging slump. It should pick up again sometime around the fall. This is for many reasons such as me just being busier over the last few months (we had visitors almost all of July and August, and we have been away from the boat a lot so far this fall already), as well as the summer months usually just being a little bit slower for personal finance websites.

Currently, I am working on creating my next blogging-related product to sell, which will be about how to earn money through sponsored posts on a blog. You can sign up for the waitlist here. I was supposed to launch this earlier in 2018, but since we found the boat sooner than expected, I haven’t had much time to work on it. Things should become more “normal” with the boat soon, which means that things may start to slow down (they won’t slow down completely but that’s just #boatlife for ya!).

Anyway, to get back to my monthly income…

I never thought that I would ever earn over $1,000,000 a year, especially with a blogging business.

While my income levels are high, I do want everyone to remember that I started at $0 a month and have grown my income to where it’s at now through a lot of hard work.

Before you think that $100 or even $1,000 is out of your league, you should remember that it is not!

I, myself, used to think that it would be great to one day earn $1,000 online and through my blog. I looked up to many bloggers who were earning over $10,000 a month, and I thought it was impossible.

Now, I’m here to show everyone that it is possible! Through hard work and dedication, you never know where life may lead you.

As you can see, September was another great month. It was great on all fronts – blogging, course-wise, life, and everything else. The business is doing well and I’m very happy with it. I’ve been catching myself saying “Life is really good” a LOT. And, I truly mean it. Life is really good!

My business is growing, I have tons of amazing ideas for this year, and I am very excited about everything. I really love my business and I don’t know where I would be without it.

My Making Sense of Affiliate Marketing course is still doing very well as I had many new students join the course recently. It’s still not showing any signs of slowing down – and this is still without any guest posts, webinars, etc.

If you are interested in starting a blog of your own, I created a tutorial that will help you start a blog of your own for cheap, starting at only $2.75 per month (this low price is only through my link) for blog hosting. In addition to the low pricing, you will receive a free website domain (a $15 value) through my Bluehost link if you purchase, at least, 12 months of blog hosting. FYI, if you are asking yourself “can you make money blogging?” – my top tip is to be self-hosted. This is essential if you want to monetize your blog as you will appear more professional and this will help you monetize your blog tremendously. My blogging income did not take off until after I switched to self-hosted WordPress.

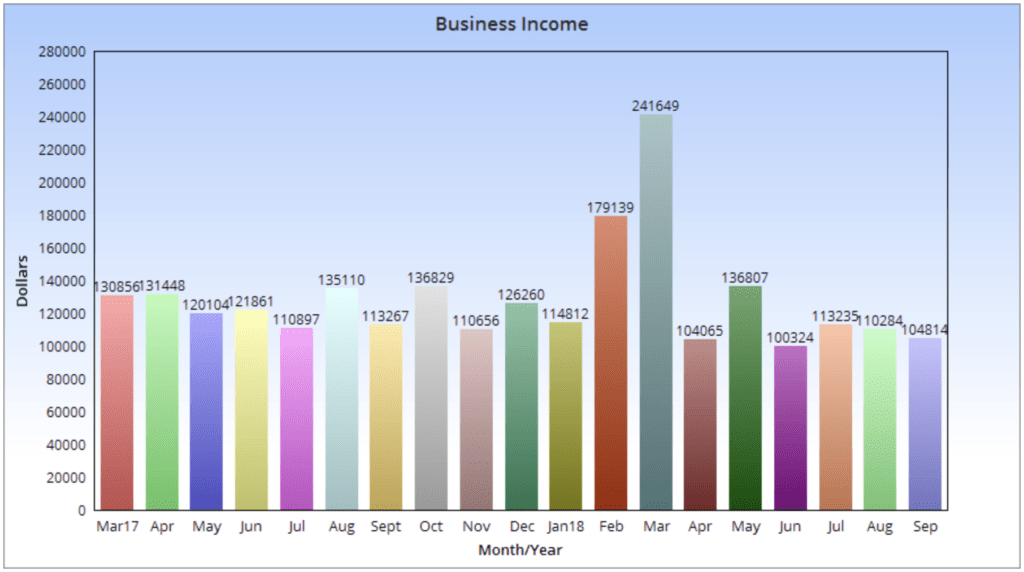

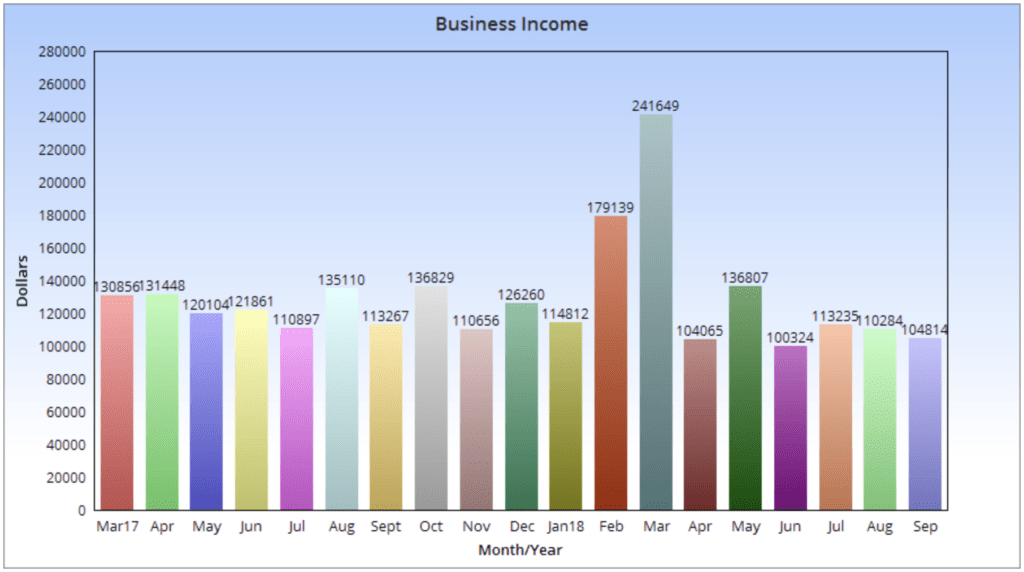

This chart only goes back to March 2017. You can find all of my income reports here.

Breakout of September 2018 income – $104,814.93

In September of 2018, I earned $104,814.93 from my blogging business. Below is how my income breaks apart in the different business income categories:

Total: $104,814.93

The income amount above is for the month of September and before any fees or expenses (some fees and expenses that lower the amount above total around $4,000 (rounded up), which include virtual assistants, Teachable course platform fee, technical assistance, newsletter expenses, PayPal and Stripe transaction fees, etc., however, this does not include taxes) being taken out. I also had expenses for the affiliates promoting my course, which totaled $4,282. After expenses and fees, I earned approximately $96,532.

Please keep in mind that I work for myself when you read my monthly income report. This means I have to cover taxes (which are over 30%), health insurance, and all other benefits/expenses that an employer may provide.

Check out The Ultimate Guide To Making Money Blogging for all of the different ways you can make money through a blog.

Below are some of my other monthly online income reports. I publish an online income update every month but only included some of them below as it would be a very long list. If you head on over to my income page you can find all of my monthly income reports from the past few years.

Comparisons and 2018 business income total:

- Total income in September of 2018: $104,814

- Total income in August of 2018: $110,284

- Difference from the previous month: -5,470

- Total in 2018: $1,205,129

Blog news – 5 Year Self-Employment Anniversary!

Fall marks 5 years since I left my day job to blog full-time!

I cannot believe that it’s been 5 years since I worked at my old day job. In fact, I keep looking at the dates because it just does not feel like it’s been 5 years. In some ways, it feels much longer than 5, and in other ways, it feels like I just started blogging full-time (it’s crazy how quickly life can pass you by!).

In case you are new here, I used to work as an analyst at an investment banking and valuation firm. I chugged along working the 8-5 Monday through Friday and didn’t see myself having a fun future there. I had a stressful job filled with lots of deadlines and responsibilities that just didn’t interest me.

Life is completely different now. I look forward to each and every single day of work – I actually look forward to Mondays now.

So much has changed in the last 5 years as well. Just around 5 years ago, I had just paid off my student loan debt, but still had a mortgage, car loans, and more.

Now, I am financially independent, I can retire whenever I want, I travel full-time, have wonderful friends and family surrounding me, have a great business, and I love life! I thought life was good back then, so that makes me even more excited for the next 5 years.

—-

Anyway, I attended FinCon (a financial media conference) in September, and it was a great time. I will be talking more about FinCon in the Featured Question below.

September was another extremely busy month for us (I can’t wait until I can stop saying that, haha!). We closed on our sailing catamaran in May and have been working on something boat-related the majority of pretty much every single day. Things will slow down eventually, but there is definitely a lot of stuff to do when you buy a boat and move onto it!

And, I know that the craziness of living on a boat has only just started. Due to this, I’m working on getting further ahead with more content. I realize that we will be extremely busy getting the hang of everything, so being ahead in content is key right now so that I can focus as much time as I can towards #boatlife.

Overall, traffic for the month was around 500,000 page views.

Below are several other business and blog-related updates:

- I am creating a new series where I will help readers with specific financial questions, and tutorials to go along with them. Topics such as: How to open a bank account, How to write a check, Finding an online bank, Building and creating an investment account, etc. What other topics would you like to see me cover?

- I am thinking about adding some sort of group coaching session to my business sometime in the future. While I used to do individual coaching, my time was limited. Group coaching would allow me to help more people and to also create a great support group for bloggers.

- My community group for Making Sense of Cents is continuing to grow. This is a Facebook group in which you can seek advice from other readers on all sorts of topics such as finance, blogging, travel, running a business, and so on. There are already over 13,000 members!

- I released my How To Start A Blog FREE Course. If you’ve been wanting to start a blog, then check this out. I created this email course for those who are interested in starting a blog, but haven’t done so yet. The course is free, and over 40,000 people have already signed up. Thank you, everyone, for the kind emails about how great the course is. Glad everyone is enjoying it!

- Due to how well my first free course went, I also created the free Master Your Money email course. It’s full of great money management lessons and financial worksheets (such as a free budget template), and I’m loving the positive response from this email course as well.

Just a quick note before we continue. I created a time-saving cheat sheet that can help you increase your affiliate income. Sign up below!

Popular new posts on Making Sense of Cents last month:

Featured Question: What are the top things you’ve learned recently?

I feature one question from a reader in each monthly income report. Please leave a comment below if you have a question that you would like me to answer.

I attended FinCon in September, and it is my favorite blogging conference. I have attended 6 times and already bought my ticket for next year.

I learn a lot at FinCon every single year, which is why I love attending.

And, it’s not just the sessions that I am learning from (those are great too!), but it’s from talking to other bloggers, money experts, and everyone else who attends FinCon (they are a very smart bunch).

So, what’s the top thing I learned from FinCon this year?

I learned from FinCon this year that… I just want to blog and it’s okay.

So many people have so many big and amazing goals such as having a talk show, becoming a famous public speaker, having an uber successful multi-million dollar business with tons of employees, and more, but I’ve learned that I’m extremely happy where I am. Don’t get me wrong, these are all great goals and I’m so glad that I’m surrounded by so many amazing people.

I’ve realized, though, that it’s just not for me and it doesn’t align with my goals and the life that I want to live. Success can have so many different forms, and for me, I am deathly terrified of public speaking so I just don’t see that as something I want to do, haha! I also know that I don’t want to run a huge company – I like my small team.

I bring this up because I receive emails all the time from bloggers and readers asking me when I’ll start public speaking, when I’ll start hiring 50 employees, and so and so on. And, I’ve been judged negatively for not doing these things.

While things may, of course, change in the future (and I’m sure they will, haha), right now I just plan on working on what I’m currently working on, and just enjoying the path that I am on.

I think I’m going to talk about this more in its own separate blog post. About how I’m slowing down and enjoying life.

I should say that I still have plenty of ideas that I learned from FinCon such as how to better manage my email inbox. I receive around 1,000 emails a day and I pride myself on the fact that I answer all of them, but it’s getting to the point where I don’t think I can do that anymore due to lack of time and to keep my sanity. Another idea is that I want to start creating more printables for my readers, both for money management and for blogging.

Tell me in the comments: What are you working on? Are you working on working less?

Past featured questions:

My plans for my blog and my business.

Plans and goals can help you run a successful business. I believe that working towards a goal can help keep a person motivated too.

Below are some of the areas I am currently working on:

-

Get at least three months ahead on Making Sense of Cents posts. I am currently less than one month ahead. I’ve definitely fallen behind ever since we got the boat! I plan on using October to catch back up in content and I already have sent several articles to my editor for editing (over 10!). Being ahead in content makes life much more enjoyable because I can focus on other things knowing that the majority of my writing work is already done.

-

Create two more products to sell. In 2016, I created Making Sense of Affiliate Marketing, and that has completely changed my life and my business. I want to create two more products to sell in 2018 so that I can continue to diversify my income. I have some plans in store and I’m excited to finally start creating more products!

-

Grow to 150,000 email subscribers. I’m hoping to see at least 150,000 email subscribers by the end of 2018.

-

Work less than 20 hours per week. For the most part, I am working less than 40 hours per week. However, there are some weeks when I spend all day and night on the laptop, not even sure where the day went. Due to that, I would like to continue to work on a better work/life balance.

-

Have fun. Okay, so this isn’t really a goal that is quantifiable or something that I’ll track, haha, but I am really looking forward to the rest of 2018 and beyond! ?

Affiliate income results.

In September of 2018, I earned $65,438 in affiliate income, as outlined earlier in this blog income report.

I have some ideas and plans to improve affiliate income further over the next several months. Soon, we will be done outfitting our sailboat, will be leaving the marina that we are currently at, and will start cruising full-time (sailing and not staying in one place). And, when that happens, internet won’t be as reliable and I’ll be much busier dedicating my life to living on the boat, so being able to earn more passive income will be wonderful.

Earning affiliate income is something that I’m extremely grateful for, especially lately. We have been so busy the last several months and I haven’t spent as much time towards the business as I would normally like.

Even though I am spending less time on the business, I am still earning a great income each month and this allows me to focus on a better work-life balance.

I’m a very big fan of affiliate income, of course. It’s something that I enjoy due to how passive it can be. It makes full-time traveling much more enjoyable when I know I can bring in an income while having fun seeing new areas.

As I always say, blogging income is not dependent on page views. Even brand new bloggers can make money through affiliate marketing. If you know the correct way to promote a product, you can succeed at affiliate marketing. This is one of the main things I teach in my Making Sense of Affiliate Marketing course.

My affiliate marketing course went live in July of 2016. I’ve already had over 5,000 people enroll in the course, and I’d love to have you as a student as well!

In the course Making Sense of Affiliate Marketing, there are 6 modules, over 30 lessons, several worksheets, bonuses, an extremely helpful and exclusive Facebook group, and more. I go through everything that you need to know about affiliate marketing, such as:

- A quick introduction to affiliate marketing and how it works

- The benefits of affiliate marketing

- The exact steps I’ve taken to earn over $500,000 from a single blog post

- How to correctly pick affiliate products to promote

- The steps to increase your conversion rate

- 80+ affiliate program ideas for different niches

- How to build trust with your readers (this is a MUST!)

- The required disclosures you need to know about

- The major tool you need for affiliate marketing

- The many different strategies to promote your affiliate links

My course is anything and everything about affiliate marketing. This course is perfect for you whether you are a new blogger or if you’ve been blogging for years, no matter what topic your blog is about, what country you live in, and so on.

I wrote this course so that it would benefit everyone, and there is so much to learn from it.

How was September for you? Are you interested in earning blogging income?

Have you ever checked in to see if you are on track for retirement? I know this can feel like a daunting task, but preparing yourself for retirement can help you save more and avoid common retirement mistakes.

Have you ever checked in to see if you are on track for retirement? I know this can feel like a daunting task, but preparing yourself for retirement can help you save more and avoid common retirement mistakes.

Welcome to September 2018’s business income report where I show you how I made money online last month. It’s time to look at this month’s update and see how I did.

Welcome to September 2018’s business income report where I show you how I made money online last month. It’s time to look at this month’s update and see how I did.

The following is a sponsored partnership with

The following is a sponsored partnership with

Do you want to pay off debt and learn how to live debt free?

Do you want to pay off debt and learn how to live debt free?

Recently, a reader contacted me and told me about how her and her husband paid off around $58,000 of student loan debt in 2 years, all while traveling. Below is their story. Enjoy!

Recently, a reader contacted me and told me about how her and her husband paid off around $58,000 of student loan debt in 2 years, all while traveling. Below is their story. Enjoy!